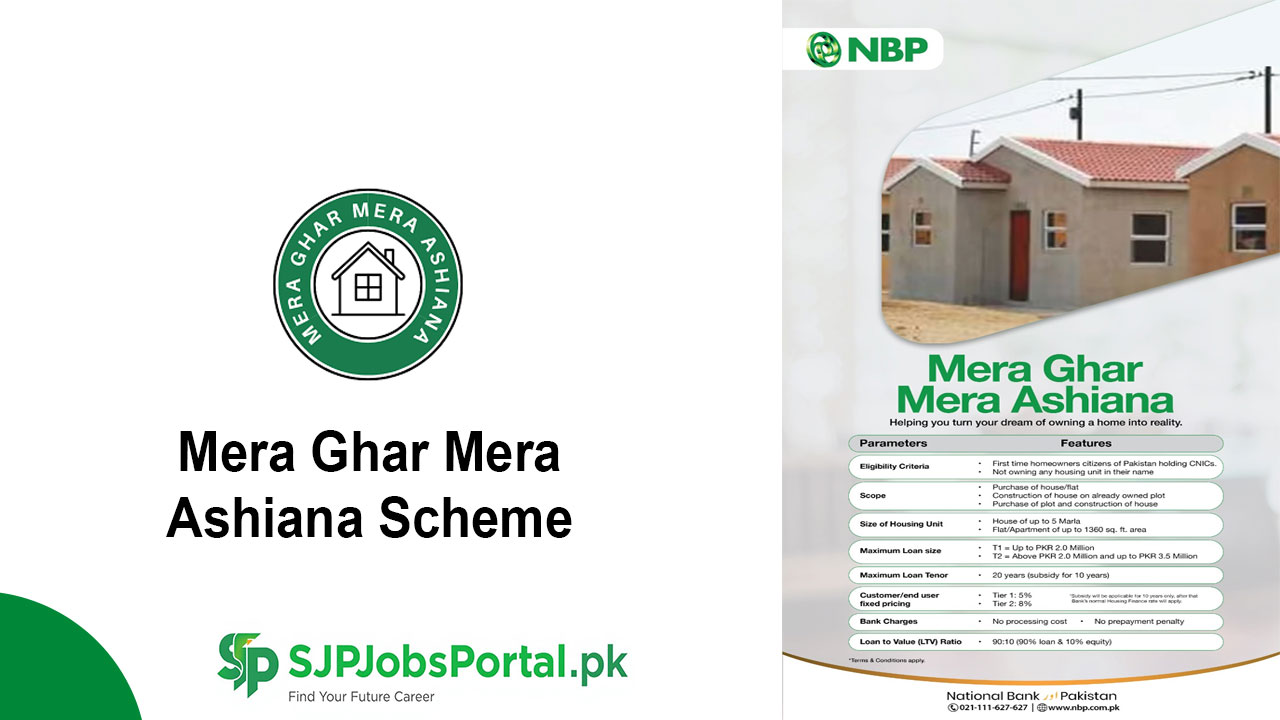

The Mera Ghar Mera Ashiana Scheme 2026 is a flagship government housing initiative in Pakistan, aimed at providing affordable home financing to low and middle-income citizens. The scheme allows eligible individuals to buy, construct, or renovate homes through easy installment plans, low markup rates, and long-term financing. Citizens can now apply online through various partner banks including NBP, HBL, BOP, and ABL.

Mera Ghar Mera Ashiana Scheme 2026 Online Apply Registration

This scheme is part of the broader Mera Pakistan Mera Ghar Program 2026, designed to support home ownership and promote housing development across Pakistan.

مزید معلومات کے لیے یا مفت آن لائن درخواست دینے کے لیے ہمارے واٹس ایپ چینل میں شامل ہوں۔ لنک پر کلک کریں اور چینل جوائن کریں

Key Features of Mera Ghar Mera Ashiana Scheme

- Financing for home purchase, construction, or renovation

- Long-term repayment options, typically 20–25 years

- Low markup rates, with fixed or variable options

- Available for both men and women

- Government-backed housing finance with NBP, HBL, BOP, and ABL

Eligibility Criteria Mera Pakistan Mera Ghar

To apply for the Mera Ghar Mera Ashiana Scheme, applicants must meet the following criteria:

- Pakistani nationality

- Minimum age: 21 years

- Stable source of income (salary, business, or self-employed)

- Acceptable credit and banking history

- Compliance with bank and State Bank of Pakistan regulations

| Blue Application Form for Formal Business (English Language) | Click here to view |

| Blue Application Form for Formal Business (Urdu Language) | Click here to view |

| Green Application Form for Formal Salaried Person (English Language) | Click here to view |

| Green Application Form for Formal Salaried Person (Urdu Language) | Click here to view |

| Pink Application Form for Informal Income Person (English Language) | Click here to view |

| Pink Application Form for Informal Income Person (Urdu Language) | Click here to view |

Required Documents Mera Ghar Mera Ashiana Scheme

Applicants must submit the following documents while applying online:

- Computerized National Identity Card (CNIC)

- Proof of income (salary slips or bank statements)

- Property ownership documents (if applicable)

- Recent passport-size photographs

- Additional documents as requested by the respective bank

Banks Participating in the Mera Ghar Mera Ashiana Scheme Application Form

The Mera Ghar Mera Ashiana Scheme is being implemented through multiple partner banks:

- NBP (National Bank of Pakistan) – NBP Online Apply

- HBL (Habib Bank Limited) – HBL Housing Finance

- BOP (Bank of Punjab) – BOP Housing Scheme

- ABL (Allied Bank Limited) – ABL Housing Finance

How to Apply Online Mera Ghar Mera Ashiana Scheme?

The online application process is simple and can be completed in a few steps:

- Visit the official website of the participating bank

- Navigate to the Mera Ghar Mera Ashiana / Housing Finance section

- Fill out the online application form with personal and financial details

- Upload the required documents

- Submit the application and note down the confirmation or application number

- Wait for verification and approval from the bank

Types of Financing Available

- Home Purchase Loans – For buying an existing house or flat

- Construction Loans – For building a new house on owned land

- Renovation Loans – For repairing or upgrading existing homes

Mera Ghar Mera Ashiana Scheme Application Form

- Affordable and government-supported home financing

- Easy installment plans and long repayment terms

- Safe and transparent application process through banks

- Promotes self-reliance and home ownership for low and middle-income citizens

Mera Ghar Mera Ashiana Scheme Application Form

The Mera Ghar Mera Ashiana Scheme Application Form is available online on each bank’s official portal. Applicants can download it if needed or complete the online registration form directly to apply for financing.

Apply Online Mera Ghar Mera Ashiana Scheme

The Mera Ghar Mera Ashiana Scheme provides a golden opportunity for Pakistani citizens to own or build their dream home. Eligible applicants are encouraged to register online today through NBP, HBL, BOP, or ABL, submit the required documents, and take advantage of this government-backed housing finance program.

Whether you want to buy, construct, or renovate a home, this scheme offers flexible, affordable, and transparent financing for all eligible citizens.